- Engelhard Silver Bars For Sale

- Johnson Matthey Silver Bars

- Old Engelhard Silver Bars

- Silver Bars Engelhard Prices Today

- Engelhard Silver Bars History 1900

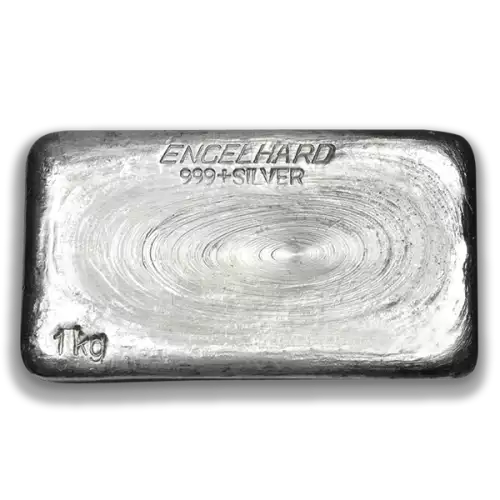

May 08, 2019 Engelhard was an active private mint for more than one hundred years, from 1902 to 2006. The Iselin, NJ-based Fortune 500 company was started by German immigrant Charles W. Over the next 20 years, Engelhard would purchase equity in a large number of precious metal companies. Pricing & History. 10 oz Engelhard Silver Bar Guaranteed.999 fine, these 10 oz bars will be from Engelhard only. The bars you receive may be die struck, loaf, or other pour style, but they all will be 10 ounces of pure Silver. This is a great product for investors! APMEX stands behind every product it sells with a satisfaction.

The history of Engelhard and their silver bars began in 1902 when Charles Engelhard purchased the company in Newark, New Jersey. At the time of its purchase, Engelhard was known as the Charles F. Croselmire Company. Throughout the early 1900s, the Engelhard company was the main fabricator of gold, silver, platinum in North America. The reverse side of the bars feature no design elements. Cast bars are often left blank on the side that faces down in the mold as inscriptions are stamped into the exposed top layer of the bar. This is the side of the bar exposed while the 100 oz Engelhard Silver Bar cools. Today, Engelhard Corporation is now owned by a German chemical.

Online Payments Accepted

Accepted Forms of Payment

American Express, Discover, MasterCard, Money Order / Cashiers Check, Paypal, Visa, Wire Transfer

Shipping

BIDHAUS provides handling, packing and shipping services at the expense of the Buyer. Bidhaus will make every attempt to ship items within 5-10 business days barring any unforeseen shipping delays as a result of Covid-19. An ESTIMATED SHIPPING and HANDLING AMOUNT will be included in the auction invoice after the sale. All U.S. domestic shipments will be insured at the total bid amount contained in the shipment at the sole discretion of BIDHAUS (other add-on charges are not covered by insurance). We pay for insurance services at our own expense as a security for both our Bidders and BIDHAUS. An Adult Signature is required upon delivery of all Bidhaus items. Large, heavy, fragile or otherwise unusual items will incur additional charges. We mainly use USPS, UPS or FedEx Ground Shipping on domestic shipments, which may take three (3) to seven (7) business days. Under special circumstances, BIDHAUS may ship items using UPS or FedEx Express Mail, private carriers or pack and ship enterprises, the cost of which shall be charged to the Bidder. BIDHAUS will not use lower classes of mail to ship sold merchandise due to increased risk of loss. Special shipping and handling requests may be accommodated on a limited basis at BIDHAUS sole discretion and may incur additional handling charges. All costs charged to a Bidder's original invoice are estimates and BIDHAUS reserves the right to charge additional amounts if such estimates are exceeded. By acknowledging this Agreement, Buyer agrees to any additional charges as may be necessary to accommodate special shipping and handling requests.

Shipping and handling charges to Hawaii, Alaska, the U.S. Territories and Foreign Countries are higher and often require registry or express mail. The shipping carriers may also limit insurance coverage to foreign locations. BIDHAUS will allow pickups on a case by case basis at its sole discretion.

International Shipping

BIDHAUS will ship items to foreign locations using the same classes of mail and additional postal services that it uses to ship to U.S. locations, to the extent that such services are available. Please be advised that insurance coverage may be limited or unavailable for those locations. To the extent foreign bidders are aware of alternative shipping arrangements, which may be desired to increase insurance coverage, we advise them to notify BIDHAUS of such options. BIDHAUS shall not be liable for any shortfall of insurance either on foreign shipments or on the non-coverage of additional invoice charges exceeding bid amounts. BUYERS ARE RESPONSIBLE FOR ALL INTERNATIONAL CUSTOMS DUTIES AND/OR TAXES. We are not told in advance of what a given country may charge for customs duties and/or taxes.

Silver bars represent one of the best ways of owning silver bullion. Many investors enjoy the artistic flair of silver rounds. Others prefer their silver in the form of legal tender money, like the American Silver Eagle or Canadian Silver Maple Leaf.

Those wanting to maximize their investment will often buy silver bars. Of the three primary types of investment silver—coins, rounds, and bars—silver bars generally have lower premiums per troy oz over the silver spot price. Large silver bars will have the lowest prices of all, due to lower labor costs per ounce.

Types of Silver Bars

Broadly speaking, there are two types of silver bars: minted, and poured. Minted silver bars are made similarly to silver coins and rounds. 'Blanks' are cut from extruded silver bar stock, then struck with large dies in a hydraulic press. Minting silver bars is much faster than making poured silver bars.

Poured silver bars use molds of graphite or steel. The correct amount of molten silver is poured into each mold, then allowed to cool. Poured silver bars are more labor-intensive than minted bars. This results in them having higher premiums over the silver spot price than minted bars. For this reason we will only cover minted silver bullion bars for this article.

Common silver bar sizes include one ounce, five ounces, and 10 ounces. 100 ounce silver bars and kilo silver bars are less common.

'Name Brand' Silver Bars

'Name Brand' silver bars refers to silver bars that sell at a premium to 'generic' silver bars from lesser-known companies. When you buy silver bullion bars from one of these companies, you will pay a bit more. On the other hand, you will receive more when you decide to sell.

Major 'name brand' silver bar companies include Engelhard, Johnson Matthey, Royal Canadian Mint, and PAMP Suisse.

Engelhard Silver Bars For Sale

Engelhard Silver Bars

Hand-poured Engelhard silver bar

One of the oldest and most trusted names in the silver bar market is Engelhard. Investors have been buying Engelhard silver bars for more than a century. The last Engelhard silver bars were minted in the 1980s.

This means virtually all these vintage ingots are considered collectibles. As a result, Engelhard silver bars cost a bit more than a standard generic 100 ounce silver bar. The robust collectors' market for Engelhard silver bars also means that you will recoup that premium when you sell.

Johnson Matthey Silver Bars

Johnson Matthey kilo silver bar

The Johnson Matthey legacy stretches back to 1817 when Norton Johnson opened his gold assaying company in London. He formed a partnership with George Matthey in 1851. They were one of the first companies to refine platinum and palladium, as well.

Johnson Matthey investment silver bars are no longer in production. Production of the vintage poured 100 oz silver bars ended in the 1980s. Production of modern JM silver bars continued until 2015, when JM sold its investment precious metals division.

JM silver bars are often the preferred choice for bulk sizes

JM silver bars remain among the most popular brand name silver bars on the market today. Like Engelhard, vintage Johnson Matthey silver bars have a growing collector marketplace. When the time comes to sell your Johnson Matthey silver bar, the collector demand for JM silver means there is always a ready market of buyers.

Johnson Matthey Silver Bars

Royal Canadian Mint Silver Bars

The Royal Canadian Mint is one of the world’s most respected and celebrated government mints. Their impeccable quality coins represent the gold pinnacle in modern minting. While the RCM is well known for its gold and silver bullion coins, they also produce high-quality silver bars. Royal Canadian Mint silver bars come in various sizes. The 10 oz silver bullion bar from RCM is one of their most popular.

1 kilo RCM silver bar

Royal Canadian Mint silver bullion bars are highly liquid and can fetch premium returns for investors. They are on par with Perth Mint silver bars, which are issued by the government of Western Australia.

PAMP Suisse Silver Bars

PAMP (Produits Artistiques Metaux Precieux) is one of the world's largest private precious metal refiners. It was founded in Switzerland in 1977 and is part of the MKS Group. PAMP is one of the most widely recognized bullion companies today. They have pioneered many innovations, making them a leading name in investment bullion. The firm even launched vending machines that dispense bullion products!

When it comes to silver bars, PAMP Suisse offers options for every investor of any budget. The production line includes silver bars ranging in size from 10 grams to 1 kilo and beyond. PAMP bars are often similar in appearance to Credit Suisse silver bars.

Generic Silver Bars

'Generic' silver bars are bars that have no extra premium over their minimum mark-up. These common silver bars are the most fungible type of silver bullion. They are interchangeable with each other, with no difference in price. Generic silver bars can be made by any of a countless number of private mints.

However, some of these mints take more care with making silver bars than others. These are some of the better 'generic' silver mints:

Sunshine Minting Silver Bars

Sunshine Minting 10 oz silver bar

Idaho-based Sunshine Minting, Inc. is a leading supplier of silver bars and other bullion products. They are a trusted supplier of blanks of different metals to private and government mints worldwide.

Sunshine Minting produces a wide array of silver bars in weights of 1 oz to 100 oz. They are available in various designs and formats suitable for the tastes of any silver investor or collector.

The company's silver rounds, which in the 1980s and 1990s were branded under 'Sunshine Mining' and 'Sunshine Silver,' are known for their eagle design and often having mirror-like proof finishes.

Mason Mint Silver Bars

Mason Mint 10 oz silver bars also come with an antiqued finish option

Mason Mint is a contemporary bullion firm making a wide range of silver products, including silver bars. The company offers a handsome selection of standard silver bars as well as art bars and poured bars in various weights and shapes.

Mason Mint silver bars are popular with investors who want high-quality ingots at a lower price than comparable silver rounds or silver coins.

Trident Silver Bars

Trident is another private mint noted for outstanding quality. Most of their silver bars bear the image of the sea god Neptune and his iconic, three-pronged scepter. Trident silver bars are available in 1 oz, 5 oz, 10 oz, 50 oz, 100 oz, and 1 kilo sizes, in an array of beautiful designs.

Trident silver bars also come in hand-poured varieties

Buying the Best Silver Bars

The key to purchasing silver bars is to shop with a reputable coin dealer or bullion broker. Online bullion dealers buy and sell in large volumes, allowing them to offer lower prices.

Online precious metals companies often advertise new bullion deals on their website. It pays to check regularly, even if you aren't looking to buy

Old Engelhard Silver Bars

Always research the silver bullion dealer you work with. Check their rating with the Better Business Bureau. Membership in the American Numismatic Association and Professional Numismatists Guild is a plus.

Prominent silver investment firms strive to offer the best service. They will not only sell their silver bars at fair prices, but they will also pay well for the silver bars you wish to sell.

Call a precious metals expert today to discuss which silver bars are the best option to meet your bullion investment goals.

Silver Bars Engelhard Prices Today

Engelhard Silver Bars History 1900

Joshua McMorrow-Hernandez is a journalist, editor, and blogger who has won multiple awards from the Numismatic Literary Guild. He has also authored numerous books, including works profiling the history of the United States Mint and United States coinage.

More silver buying guides from the author: